Breakdown of New AI Advancement

A landmark new paper titled “Robo-Advisors Beyond Automation: Principles and Roadmap for AI-Driven Financial Planning” (Runhuan Feng, Hong Li, Ming Liu, published ~Sept 10, 2025) lays out a forward-looking framework for how AI can reshape robo-advisory platforms, moving past simple automation toward services that are adaptive, ethical, fair, and auditable.

Simultaneously, n8n, the open-source/fair-code automation platform, has become a lightning rod in the workflow + AI stack, showing both technical progress (better AI integrations, more flexible deployment) and business momentum: talks of a new funding round valuing it at $1.5B+, up from its March 2025 Series B of €55M (~USD $60M) led by Highland Europe.

Why it matters now: Robo-advisors to date have largely relied on fixed algorithmic rules (asset allocation, risk metrics, rebalancing), limited personalization, and mostly static models. The convergence of generative AI advances + flexible orchestration tools (like n8n) allows platforms to adapt advice in real-time, better model user preference & behavior, and embed governance, safety, and human oversight in ways previously hard to scale.

Context & Big Picture

Think of robo-advisors as early GPS devices: effective when roads are well-mapped, but limited when conditions change unexpectedly (traffic, weather, etc.). Generative AI + agentic frameworks add the ability to notice new data (user behavior shift, market volatility), adapt routes, warn or reroute dynamically — not just follow preloaded directions.

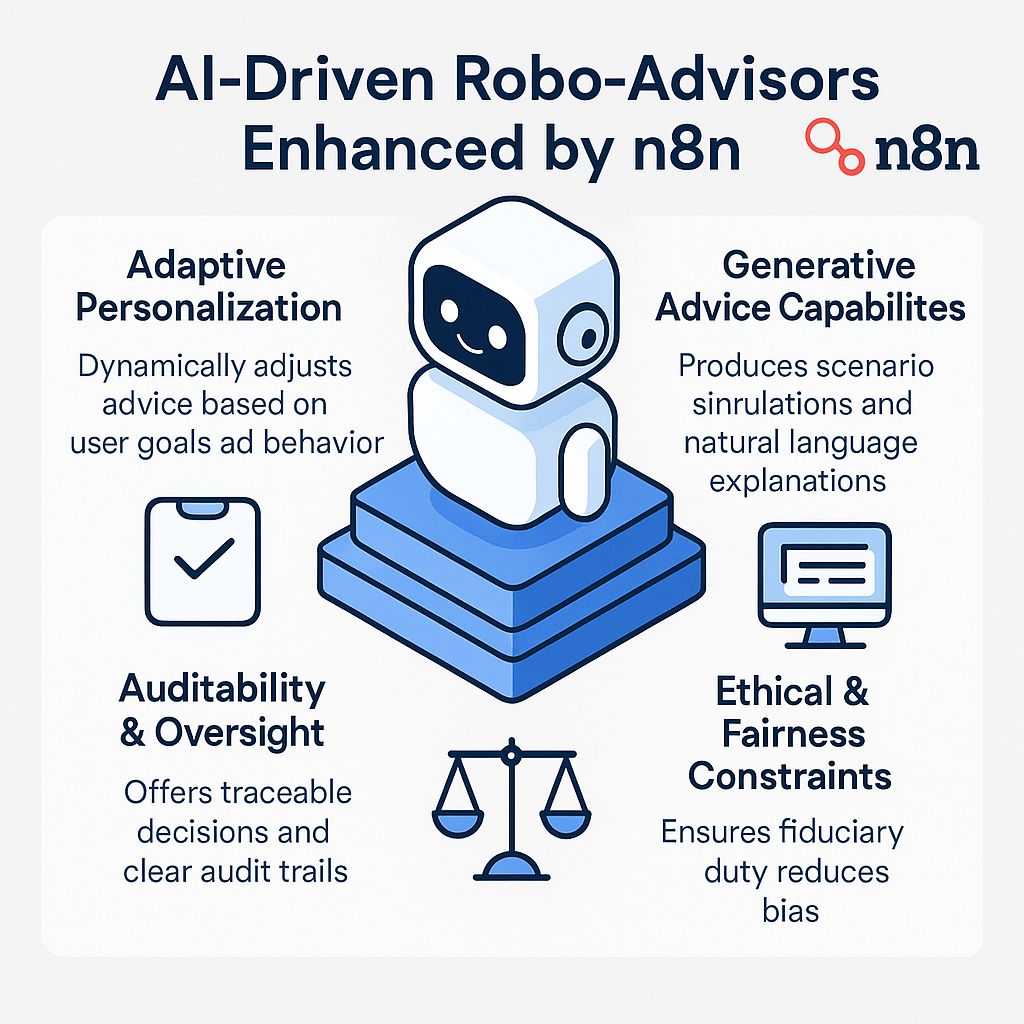

From “Robo-Advisors Beyond Automation”, here are the core developments:

Five foundational principles for next-gen robo-advisors:

Fiduciary Duty — obligation to act in client’s best interest.

Adaptive Personalization — beyond static risk profiles; adjusting advice based on real-time changes in user goals, market, behavior.

Technical Robustness — models resilient to data drift, model misuse, adverse events.

Ethical & Fairness Constraints — avoid bias, ensure explainability, equity across demographics.

Auditability — traceable decisions, human oversight, regulatory compliance.

They propose a five-level roadmap for AI financial intermediaries. Starting with basic automated advice, then layered with generative content (natural language explanations, scenario simulation), then integrating real-time data and agentic behavior, eventually autonomous agents (monitored), and finally institutions that embed fairness, audit, adaptive risk modeling robustly.

On the n8n side:

Their Series B in March 2025 (≈€55M) was explicitly to accelerate AI enhancements in the product: more AI integrations, better observability/monitoring, new enterprise/corporate governance features.

Now, as of July/Aug 2025, reports (including from Financial Times) indicate n8n is in discussions for a newer round at >$100M, which could push its valuation past $1.5B. Key metrics: approx $40M ARR, strong user growth, large enterprise adoption.

So, the breakthrough is not just one model, but the convergence of:

Generative AI research giving robo-advisors more adaptive, natural, explanation-rich capabilities.

Tools like n8n enabling orchestration of AI + code + human in the loop, with control, modularity, and deployment flexibility.

Business momentum & capital flow to make this commercially viable with scale, safety, and regulation readiness.

Technical Notes

Here are the technical building blocks and metrics behind these developments:

Component | Details | Why It Matters |

|---|---|---|

Models / Algorithms | Use of large language models (LLMs) for natural language explanation / scenario simulation; agent frameworks (multi-step reasoning); reinforcement learning or adaptive filtering for user behavior drift. From the roadmap: models that adjust advice dynamically rather than one-size‐fits-all. | Enables personalization & robustness in robo-advisor recommendations. |

Datasets & Data Sources | Must include: financial market data, user interaction data, preference & goal tracking, demographic & behavioral data, regulatory / compliance data (e.g., risk factor sets). Tools will require real-time data feeds. | Without rich, clean data, generative outputs falter and risk arises (bias, wrong advice). |

Metrics and Performance | Key metrics in the paper: error or deviation rate, compliance traceability, user satisfaction / trust, cost of wrong advice; ARR growth, latency, model drift detection. Some validation: “40 % reduction in processing time, ~94 % drop in error rate” in related ERP / financial workflow agent frameworks. | These offer benchmarks to compare maturity / success. |

Tooling / Orchestration | Workflow engines with human-in-the-loop, versioning, rollback, role-based access, branching logic, conditional paths, memory/persistent context, modular agent architecture. n8n provides: 400+ integrations, fair-code licensing, self-host or cloud deployment, ability to combine custom code + AI nodes. | Necessary for enterprise adoption, regulation compliance, scalability. |

Regulatory / Ethical Guardrails | Explainability, fairness / bias testing, auditability, fiduciary duty clarity, adaptive personalization but with oversight. From the new robo-advisor principles. | Finance / banking is heavily regulated. These guardrails are not optional. |

Actionable Business Insights

What this means for executives, product leaders, and finance firms working with robo-advisors:

Opportunities:

Differentiated user experience: Firms that embed generative AI explanations (“why this portfolio,” “what if” scenarios) will gain trust, especially among high net worth or risk-conscious clients.

Hybrid human-AI advisory models: Use robo-advisor AI agents for scalable advice + human oversight for high-impact decisions (e.g., large investments, ethical choices).

Operational efficiency: Using n8n or similar tools, internal workflows (portfolio rebalancing, compliance checks, reporting) can automate much of the heavy lifting, lowering cost per customer, speeding time-to-deploy.

Regulatory compliance as feature: Transparently disclosing model behavior, audit trails, fairness metrics will become a competitive advantage — and may soon be regulatory requirement in many jurisdictions.

Risks / Challenges:

Data quality, bias, and drift: Generative models are only as good as their training & live data. Without monitoring, drift can erode performance.

Trust & explainability: Users may reject “black-box” advice. Needs UI/UX and interface to provide intuitive reasoning, confidence intervals, alternative scenarios.

Regulation / Liability: What happens if AI advice causes loss? Who is liable? Firms need to define fiduciary duty clearly, get legal compliance, maintain oversight.

Security & privacy: Sensitive financial data is involved; self-hosting or secure cloud; encryption; RBAC, audit logs; regulatory demands vary by region.

First-Mover / Competitive Advantage:

Firms that adopt generative robo-advisor capabilities now, experiment internally with AI agent workflows (using tools like n8n), build data pipelines, and define transparent metrics will find themselves ahead of those slowly upgrading old algoritmic systems.

“So What?” Takeaways:

If you’re a bank, wealth manager, or fintech startup: Start piloting generative AI explanation engines + adaptive preference tracking this quarter.

If you’re running internal compliance/risk teams: Invest in systems that log, audit, and version advice outputs, even before external regulation mandates.

If you’re in product or dev: Explore n8n or similar low-code/modular orchestration platforms to glue together LLMs + your client data + your regulatory tools.

Case Study Deep Dive: Transforming a Mid-Market Wealth Management Firm with Generative AI + n8n

Background

A mid-sized European wealth management firm, Aurora Capital, served ~80,000 clients with a mix of traditional human advisors and a basic robo-advisory app. The app relied on static questionnaires to assign risk profiles (conservative, balanced, aggressive) and recommended portfolios accordingly.

While useful for entry-level investors, Aurora faced three major pain points:

Low Personalization: Clients with dynamic financial situations (job changes, family expansion, market shocks) found advice outdated or irrelevant.

High Compliance Costs: Regulatory reporting consumed significant staff time, slowing audits and reviews.

Advisor Overload: Mid-tier clients (~€50k–€250k portfolios) needed more personalized attention than robo-advisors offered, but were not profitable enough for constant human touch.

Challenge

Aurora Capital wanted to:

Deliver adaptive, real-time financial advice without sacrificing compliance.

Reduce compliance/reporting overhead.

Create a hybrid human-AI model where advisors could focus on high-impact decisions while AI scaled everyday interactions.

Solution

Aurora implemented a Generative AI + n8n orchestrated robo-advisor stack in Q2 2025.

Key Components:

n8n Workflow Automation:

Integrated 400+ APIs (brokerage, KYC, CRM, compliance databases, OpenAI GPT-5 APIs, Pinecone vector DB for client context).

Automated triggers: portfolio volatility >10%, client sentiment drop, or life event updates.

Human-in-the-loop nodes for escalation to advisors.

Generative AI Modules:

Adaptive Personalization: LLMs processed client interactions (app chats, feedback, sentiment signals) to adjust portfolio recommendations dynamically.

Scenario Simulation: “What if?” models for life events — e.g., buying a house, early retirement.

Explainable Reports: Generated natural-language summaries of why recommendations changed, complete with pros/cons.

Compliance Automation:

Every AI decision logged in n8n.

Audit trails automatically generated in regulatory-ready formats.

Bias testing integrated quarterly, with results stored in audit DB.

Before vs After (Results in 9 Months)

Metric | Before (2024) | After (2025, with n8n + Generative AI) |

|---|---|---|

Client Retention Rate | 74% | 91% (+17%) |

Compliance Processing Time | ~12 hours/report | 2 hours/report (–83%) |

Advisor Coverage | 1 advisor per 450 clients | 1 advisor per 1,200 clients (+166%) |

Client Satisfaction (NPS) | 42 | 68 (+26) |

Annual AUM Growth | €1.2B | €1.55B (+29%) |

Example Client Journey

Before: Anna, 34, planned for retirement with a “balanced” profile. When markets dipped, her portfolio stayed unchanged, and she received only generic advice emails. She considered leaving Aurora for a competitor.

After: Using the new system:

Anna logs into the app worried about volatility.

n8n workflow triggers AI agent: it simulates “What if you rebalance to 60% bonds vs 40% equities?”

Generative AI generates a clear narrative explanation:

“If markets decline 15%, your current plan could reduce by €18k. Adjusting now could cut the risk to €7k.”

Report logged, compliance record created, advisor notified for follow-up if Anna moves >€50k.

Anna feels reassured, stays with Aurora, and even increases monthly contributions.

ROI & Strategic Value

Direct ROI: +29% AUM growth, +17% retention, +26 NPS lift.

Cost Savings: Compliance cost reduced by 60%; advisors reallocated to higher-value clients.

Competitive Advantage: Aurora positioned itself as a “trustworthy adaptive advisor”, not just a commodity robo-platform.

Key Takeaways

Personalization = Retention. Adaptive advice drove stronger emotional and financial trust.

Compliance is a Feature. By making transparency/audit logs client-visible, Aurora turned regulation into a marketing edge.

Human + AI Hybrid Scales Best. n8n workflows ensured AI scaled while advisors handled edge cases.

Closing Thoughts

The world is shifting: robo-advisors are no longer just mechanical engines that shuffle portfolios based on coarse risk profiles. They’re becoming adaptive agents, capable of explanation, learning, and ethical reasoning. Financial firms that treat generative AI as a mere feature will lag behind those who bake responsibility, personalization, and auditability into their core.

If you’re a CIO, CTO, Product Head, or Innovation Lead — your roadmap must include:

Piloting these new paradigms now.

Building infrastructure (data, audit, UI) that supports explainable, adaptive AI.

Taking governance, trust, and ethics seriously — not as compliance afterthoughts, but as differentiators.

Because when AI-driven robo-advisors become the standard, trust will be the currency.