Why This Matters Now?

You may have heard of chatbots—but what if AI could autonomously watch markets, parse regulations, and whisper warnings before risk materializes?

LangChain’s LangGraph just made that possible—and it's already being piloted in the financial trenches.

Context & Big Picture

What happened?

LangChain, the framework behind agentic AI, unveiled its LangGraph platform in May 2025 at Interrupt: The AI Agent Conference. The platform, now GA, enables stateful, long-running AI agents designed for real-world enterprise workflows.

Why it matters:

For marketing execs in financial services, this isn’t abstract R&D—it’s a next-gen AI that can monitor, interpret, and act on risk signals autonomously. Paired with agentic LLM frameworks, LangGraph empowers systems that evolve with market volatility and regulatory shifts, driving proactive, competitive risk management.

Global trend alignment:

Agentic AI is rapidly rising—investors, fintechs, and banks expect autonomous LLM agents to revolutionize how we assess and respond to risk.

Recent academic advances—like LLM-enabled cross-asset real-time monitoring—demonstrate improved accuracy and faster detection of emerging threats.

Regulation and model oversight are catching up: frameworks now demand enhanced validation, guardrails, and governance to safely operationalize GenAI in finance.

Technical Notes

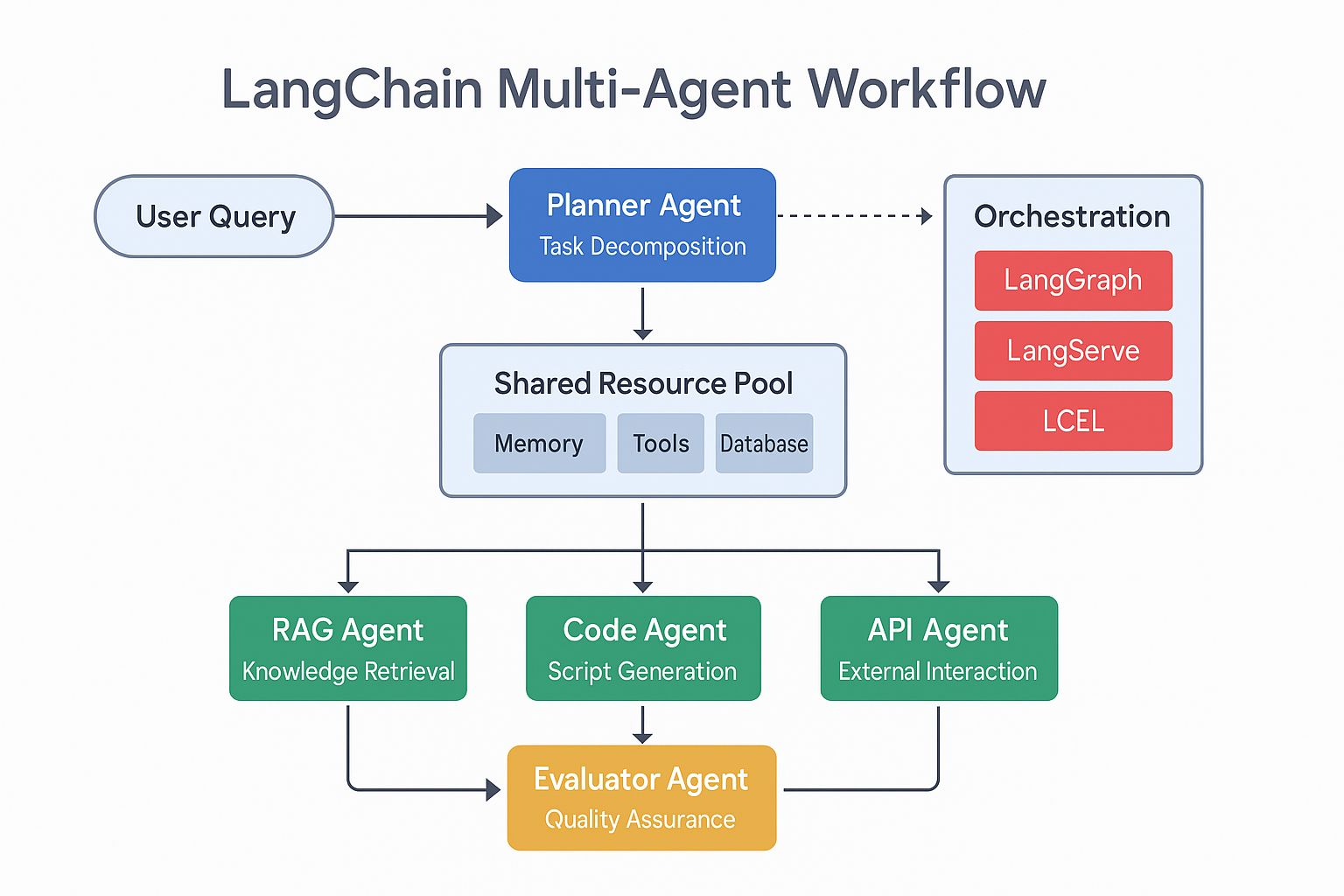

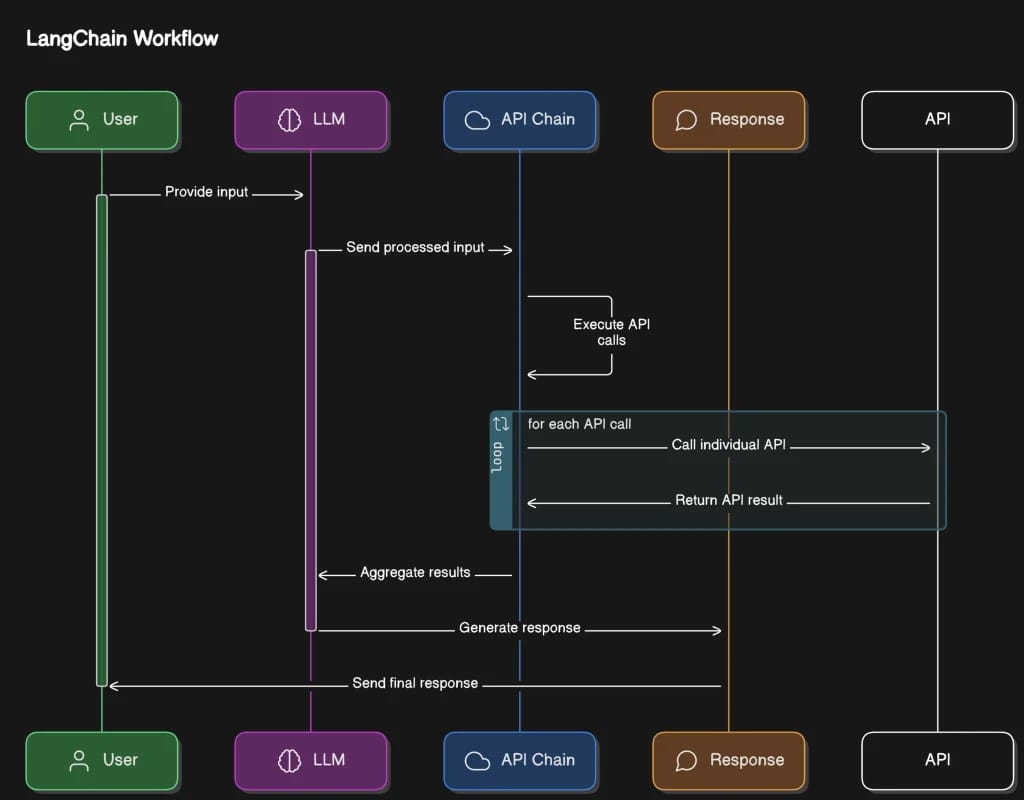

LangGraph:

Orchestrates stateful LangChain agents: planner, retrieval, API, evaluation.

Supports multi-agent concurrency and fallback error recovery.

LLM Cross-Asset Risk Framework:

Ingests unstructured news/regulatory text + structured market data.

Uses LLMs to interpret narratives, correlate with numeric signals.

Backtested: outperforms traditional metrics-based risk models in predicting shifts.

Model Risk Controls:

Incorporates hallucination detection, adversarial testing, explainability.

Aligns with enhanced governance frameworks tailored for GenAI in finance.

Actionable Business Insights

Audience | Opportunity |

|---|---|

CEOs / CROs | Launch pilot teams using LangGraph-powered risk agents for real-time oversight and decision agility. |

CTOs | Integrate risk agents into internal risk dashboards; require audit logs and guardrails. |

Product Managers | Bundle LangGraph-based risk tools into enterprise risk suites; market as autonomous monitoring. |

Investors | Track FinTech ventures harnessing agentic AI for security and risk—we’re at the cottage industry’s tipping point. |

Analysts | Use agents to pre-filter and synthesize risk narratives before human intervention. |

Think of LangGraph like a 24/7 digital risk analyst squad—they never sleep, they scan data everywhere, and they never miss a signal.

Like security cameras in a mall—but for your financial ecosystem.

These agents connect to data feeds, news APIs, regulatory publications, and internal systems.

They learn, reference historical context, debate their own outputs, and escalate early warnings.

Unlike static dashboards, they evolve, adapt, and initiate risk scenario plays proactively.

Risks & Hurdles:

Regulatory scrutiny over AI decisions

Hallucination or misinterpretation causing false alarms

Governance maturity and auditability still catching up

Case Study Deep Dive: LangGraph in Marketing-Risk Fusion

Scenario: A marketing team at a major retail bank wants to launch a new climate-risk-aware ESG loan product. They need daily analysis of climate regulation changes, climate-linked market shifts, and credit portfolio sensitivities across FX, bonds, and equities.

Implementation:

Deploy LangGraph agents:

News Agent: Monitors climate regulation updates.

Market Agent: Reads real-time market trends across asset classes.

Evaluation Agent: Scores combined risk exposure.

Alert Agent: Triggers daily dashboards and red-flag alerts to marketing and risk managers.

Impact:

Metric | Before | After LangGraph Deployment |

|---|---|---|

Time to Insight | Weekly manual research | Real-time alerts & dashboards |

Risk Blind Spots | Lost in data noise | Early detection of policy + market shifts |

Marketing Latency | Slow pre-launch reviews | Agile messaging aligned with risk signals |

ROI | Hard to quantify | Faster launch, lower risk exposure, better compliance alignment |

Pros: Proactive risk alignment with marketing; saves teams hours; sharpens campaign messaging.

Cons: Requires careful tuning; human-in-the-loop validation still essential; initial configuration costs.

Closing Thoughts

The world of financial risk is moving from reactive conflict to anticipatory clarity—thanks to agentic AI like LangGraph. If marketing teams can tap into these autonomous thinkers, they can align strategy, messaging, and product launches with real-time risk signals—leaving competitors scrambling.